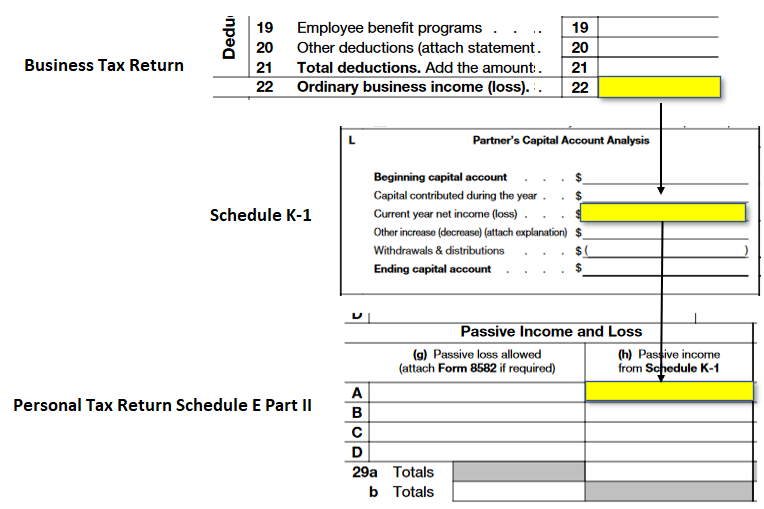

Line 1 - Ordinary Income/Loss from Trade or Business Activities - Ordinary business income (loss) reported in Box 1 of the K-1 is entered as either Non-Passive Income/Loss or as Passive Income/Loss. See: KB Article on Adjusted Basis Worksheet and Publication 925 - Passive Activity and At-Risk Rules. These amounts do not take into consideration the following limitations: the adjusted basis of the partnership interest the amount for which the taxpayer is at risk or the passive activity limitations. The amounts shown in boxes 1 through 11 reflect the taxpayer's share of income items from the partnership. A description of the income items contained in boxes 1 through 11, including each of the Codes for Other Income (Loss) that can be entered in Box 11 can be found below.

The K-1 1065 Edit Screen in the tax program has an entry for each box found on the Schedule K-1 (Form 1065) that the taxpayer received. If the initial K-1 entry was previously keyed in, double click on the entry in the K-1's pick list.Īfter entering all of the information required on the K-1 Heading Information screen, select ‘OK’. The K-1 1065 Edit Screen has two distinct sections entitled ‘Heading Information’ and ‘Income, Deductions, Credits, and Other Items.’ K-1 Input - Select 'New' and double-click on Form 1065 K-1 Partnership which will take you to the K-1 Heading Information Entry screen.

To enter the income items from a K-1 (Form 1065) in TaxSlayer Pro from the Main Menu of the Tax Return (Form 1040) select:

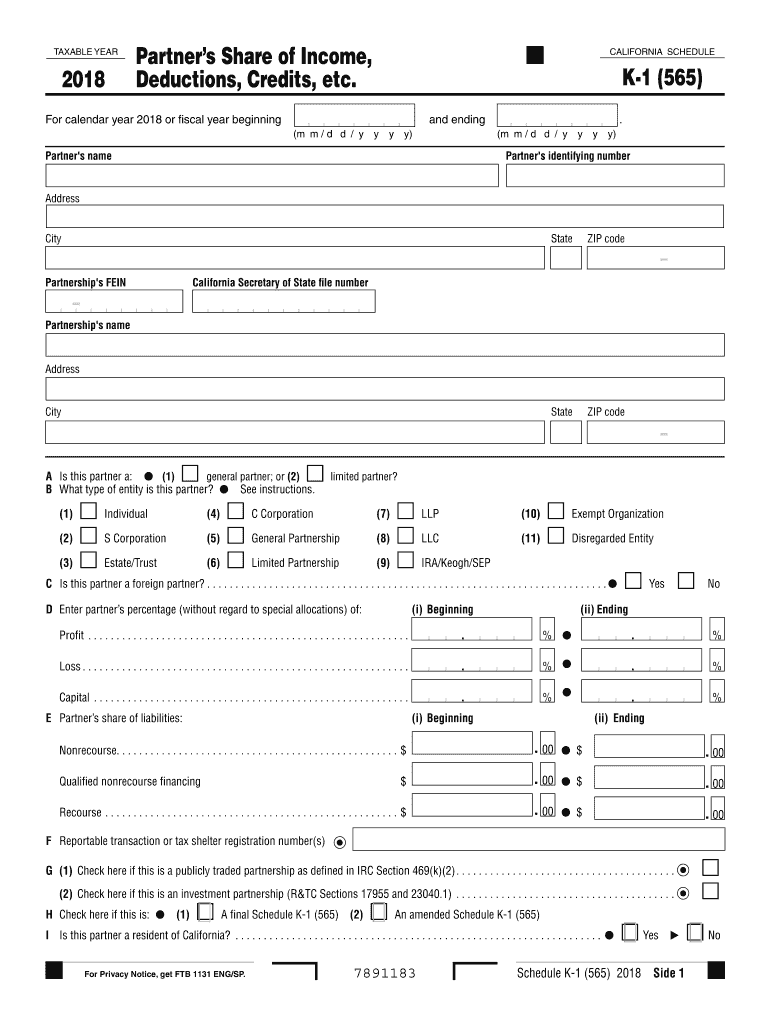

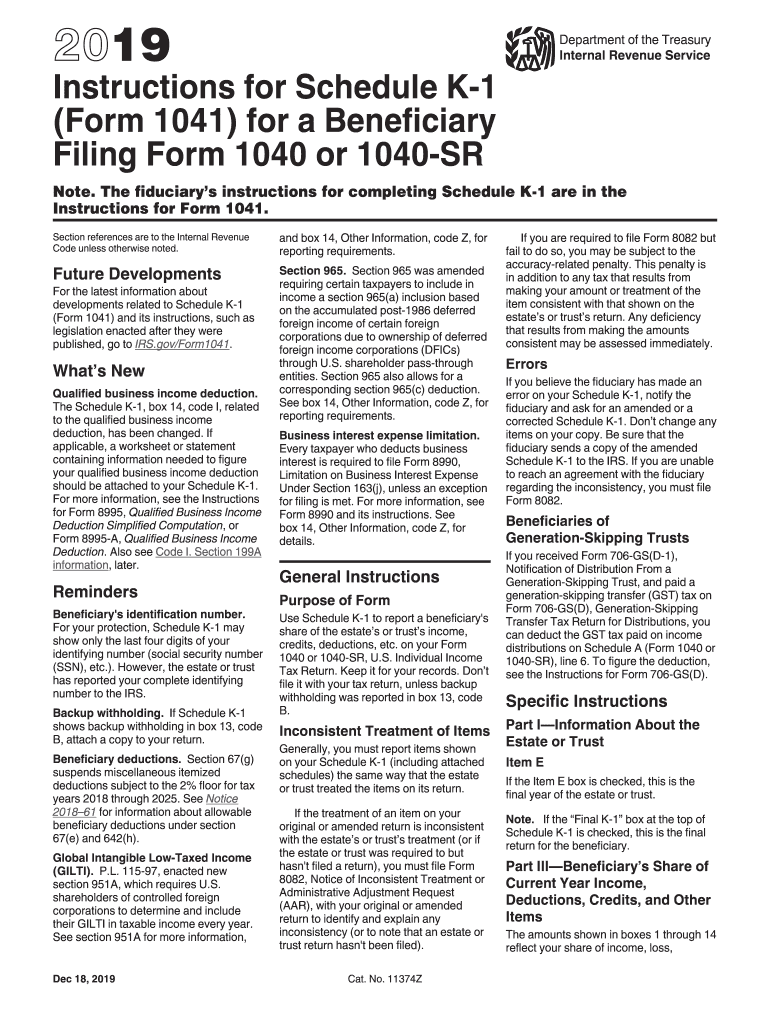

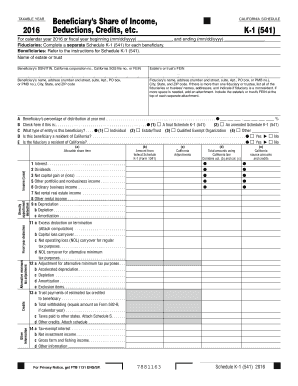

For additional information regarding the requirements for Schedule K-1 (Form 1065), see: Partner's Instructions for Schedule K-1 (Form 1065). This article focuses solely on the entry of the Income (or Loss) items which are found on Lines 1 through 11 of the Schedule K-1 (Form 1065) Partner's Share of Income, Deductions, Credits, etc.

0 kommentar(er)

0 kommentar(er)